On March 9th, 2020, Hanoi Tax Department issued Official Letter No. 10267/CT-TTHT. Whereby:

In case the Company has related-party transactions, total loan interest expenses arising in the period qualified as a deduction from income subject to corporate income tax shall not exceed 20% of total net profit generated from business activities plus loan interest costs and amortization costs arising within that period. In particular, total loan interest expenses herein are total arising loan interest expenses in the period regardless that loan interst expenses are from related party or independent party.

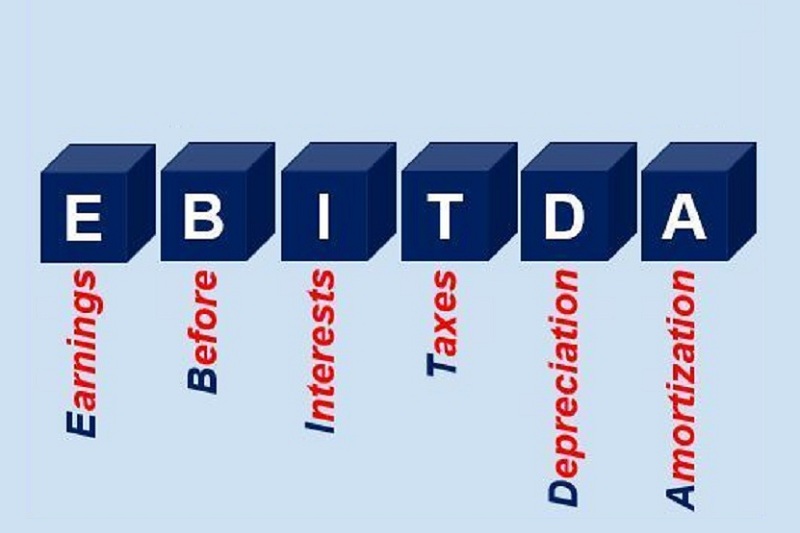

In case total net profit generated from business activities plus loan interest costs and amortization costs (EBITDA) in the period is less than 0, the company’s total loan interest expenses in the tax period are not deductible when determining CIT taxable income.